Counterpoint Research has released its Q2 2019 global shipment report, and it seems like Samsung has emerged as one of the bigger winners during the period.

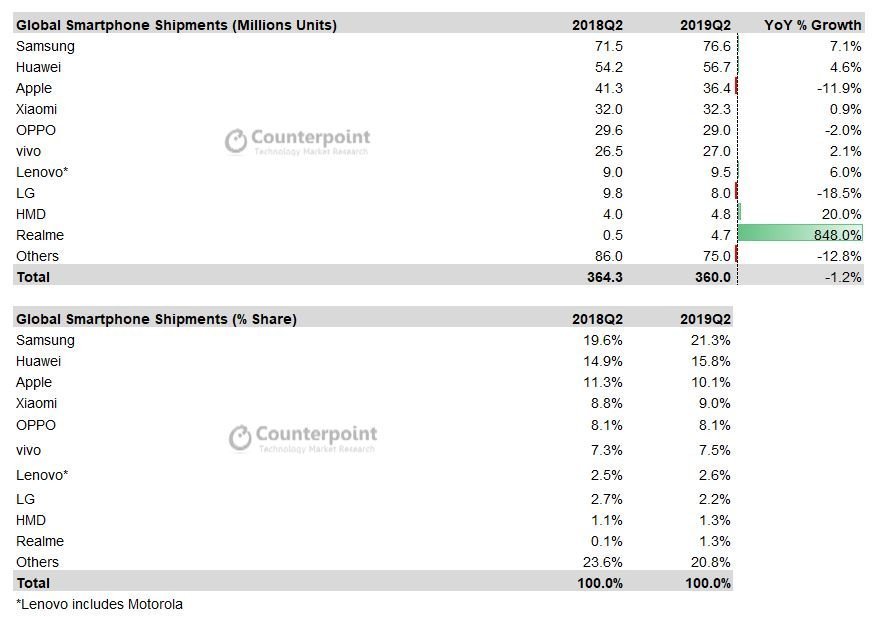

According to the tracking firm, Samsung's Galaxy S10 series and rejuvenated mid-range smartphones have resulted in a 7.1 percent year-on-year boost. The Korean manufacturer hit 76.6 million smartphones shipped in the quarter, compared to 71.5 million devices a year ago. In fact, the firm reportedly accounted for roughly a fifth of all smartphone shipments in this quarter.

Second-placed Huawei didn't see quite the same level of growth, but it still managed to achieve a 4.6 percent boost over last year. The Chinese colossus reportedly shipped 56.7 million smartphones in Q2 2019, compared to 54.2 million in Q2 2018. Counterpoint notes that the effects of the U.S. trade ban weren't fully experienced in this quarter, but that it expects a steep drop in performance come Q3.

Apple may have been in third place, but it saw a rather big 11.9 percent drop in shipments compared to Q2 2018. The firm shipped 36.4 million phones in this quarter, as opposed to 41.3 million a year ago. This performance means Xiaomi is roughly one percent away from passing Apple in terms of market-share, according to Counterpoint. Then again, Q2 isn't traditionally Apple's best quarter, as it launches its iPhone series in Q3 or Q4 anyway. But it still makes for a rather impressive turn of events.

Apple wasn't the only big loser this quarter though, as LG saw an 18.5 percent drop in shipments. The company's shipments for the quarter hit eight million units, as opposed to Q2 2018's 9.8 million.

More posts about Realme

Realme and HMD were two big winners otherwise, as the former company entered the top ten for the first time. The brand saw a 848 percent boost in shipments over Q2 2018, going from 0.5 million units to 4.7 million. HMD saw more modest gains of 20 percent over Q2 2018, hitting 4.8 million units shipped compared to four million last year.

Realme's performance means it's on equal footing with HMD in terms of market-share (1.3 percent). It also has another potential target in LG, as a continued decline could put the Korean brand in Realme's cross-hairs.

Counterpoint also notes that Q2 2019 delivered the seventh consecutive quarter of declining smartphone shipments, as shipments dropped by just over one percent. It added that the combined market-share of the five major Chinese players (Huawei, Xiaomi, Oppo, Vivo, Realme) reached its highest ever level (42 percent).

NEXT: Best Android One phones — What are your options?

from Android Authority https://ift.tt/2yreIry

via IFTTT

Aucun commentaire:

Enregistrer un commentaire